Opendoor Technologies Inc (NASDAQ:OPEN) shares are trading lower Friday, giving back some of the significant gains seen earlier in the week. Shares are pulling back Friday after co-founder Keith Rabois made comments on CNBC, stating the company is “completely bloated.” The remarks, in which he also clarified Opendoor is not a “meme stock,” add new context to the stock’s pullback following a massive rally earlier in the week.

What Else: The stock initially soared this week following Wednesday’s announcement that former Shopify COO Kaz Nejatian would take over as CEO.

The leadership change was met this week with enthusiasm from investors and analysts. JPMorgan analyst Dae Lee called Nejatian the “right leader for the AI era,” citing his tech expertise as a catalyst for accelerating bottom-line improvements and operational efficiency.

The bullish sentiment was amplified by the news that co-founders Keith Rabois and Eric Wu are rejoining the board of directors, injecting $40 million of their own capital into the company. The move was hailed as a return to “FounderMode,” sparking a 35% rally this week, despite Friday’s pullback.

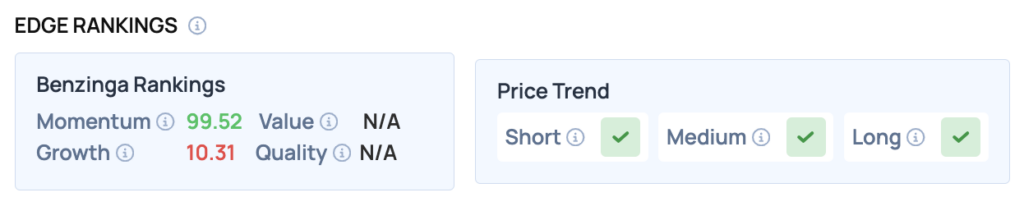

Benzinga Edge Rankings: Reflecting the recent surge, the stock’s Benzinga Edge rankings show a powerful Momentum score of 99.52.

Price Action: According to data from Benzinga Pro, OPEN shares are trading lower by 10.42% to $9.43 Friday. The stock has a 52-week high of $10.70 and a 52-week low of $0.51.

How To Buy OPEN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Opendoor Technologies’ case, it is in the Real Estate sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

- No comments yet. Be the first to comment!