Shares of Snap Inc. (NYSE:SNAP) rallied nearly 12% over the last five trading days, closing the week with significant momentum driven by a major product announcement and persistent geopolitical uncertainty surrounding its chief competitor, TikTok.

The surge was accompanied by the highest trading volumes in the company’s history, signaling a dramatic increase in investor interest.

Check out SNAP’s stock price here.

SNAP Soars Nearly 12% In The Week

The social media company's stock saw its value climb by 11.63% in a week, a rally underscored by unprecedented trading activity.

On Thursday, Sept. 18th, trading volume peaked at over 202 million shares, with the last two trading days alone accounting for nearly 400 million shares changing hands.

This activity represents a massive spike from the daily average, which often hovered below 100 million. For the entire week, volume was consistently more than double the stock’s three-month average, indicating a broad-based rush into the equity.

See Also: Snap Revenue Beat, User Growth Not Enough To Excite Shares In Q2

Snap OS 2.0 Boosts Rally

Fueling the bullish sentiment was Snap’s Sept. 15th announcement of Snap OS 2.0, a significant software overhaul for its Spectacles augmented reality glasses.

The update introduces a faster browser with WebXR support, a reimagined interface for watching Spotlight content in AR, and new developer tools.

This tangible product development provided a fundamental catalyst, showcasing the company’s continued innovation in the augmented reality space ahead of a planned public launch of Spectacles in 2026.

US TikTok Ownership, Governance Set To Shift

Adding to the momentum is the ongoing uncertainty surrounding the U.S. operations of TikTok.

As discussions around the rival app’s ownership structure continue, investors appear to be viewing Snap as a primary beneficiary of any potential disruption to TikTok’s market share.

This external market dynamic, combined with Snap’s own product news, has created a potent combination for the stock, attracting widespread attention from institutional and retail investors alike and putting its recent performance in the spotlight.

Price Action

Shares of SNAP dropped 3.32% on Friday to end at $8.16 per share. However, according to Yahoo Finance’s data, the shares surged 8.46% overnight on Monday.

The stock is down 27.40% on a year-to-date basis and 20.00% over the year.

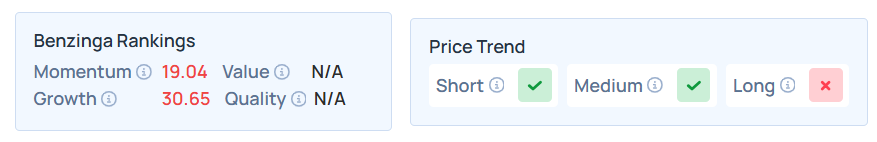

Benzinga’s Edge Stock Rankings indicate that SNAP maintains a weaker price trend in the long term but a strong trend in the short and medium terms. However, the stock’s growth ranking is relatively poor. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Friday. The SPY was up 0.50% at $663.70, while the QQQ advanced 0.68% to $599.35, according to Benzinga Pro data.

On Monday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were lower.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Poetra.RH / Shutterstock.com

- No comments yet. Be the first to comment!