Fed Decision Harder

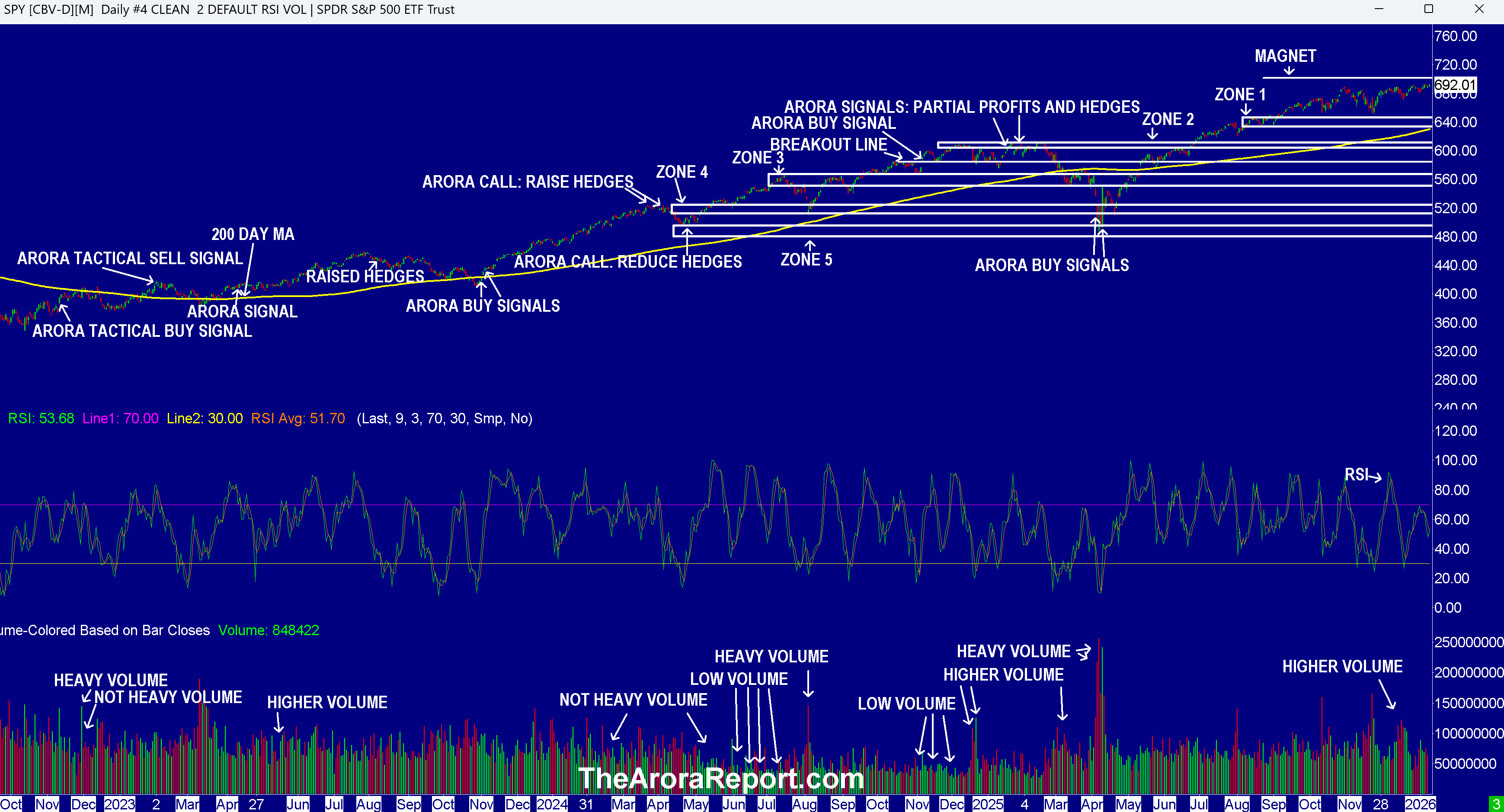

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust (NYSE:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows the stock market is consolidating just below the magnet.

- The chart shows that even though the stock market continues to levitate, RSI is not overbought. This increases the probability of the stock market hitting the magnet and breaking above it.

- The jobs report is known as the mother of all reports due to its importance. The just released December jobs report has made the Fed's decision harder. Here are the details:

- Non-farm payrolls came at 50K vs. 55K consensus.

- Non-farm private payrolls came at 37K vs. 50K consensus.

- Unemployment rate came at 4.4% vs. 4.5% consensus.

- Average work week came at 34.2 vs. 34.3 consensus.

- Average hourly earnings came at 0.3% vs. 0.3% consensus.

- In our analysis, right now, the most important number to the Fed is the unemployment rate. The fact that the unemployment rate came below the consensus makes it harder for the Fed to cut interest rates in January. The stock market is expecting an interest rate cut.

- Meta Platforms Inc (NASDAQ:META) is making a huge commitment to nuclear power by signing three deals.

- Meta is signing 20 year deals to buy power from Perry, Davis-Besse, and Beaver Valley nuclear plants for more than 2600 MW of power. All three plants are owned by Vistra Corp (NYSE:VST). The plants were previously owned by FirstEnergy Corp (NYSE:FE).

- Meta will support Oklo Inc (NYSE:OKLO) to develop 1.2 GW of power capacity in Ohio and prepay for power as well as provide funding to advance the project.

- Meta will fund two reactors from TerraPower.

- President Trump is instructing Federal National Mortgage Association (OTC:FNMA) and Federal Home Loan Mortgage Corp (OTC:FMCC) to buy $200B of mortgage bonds. President Trump is taking this action to spur home buying. In our analysis, this will reduce the 30 year mortgage rate by about 0.25%, but it will slightly increase the yield on long Treasury bonds. This is positive for home builder ETF iShares US Home Construction ETF (BATS:ITB) and stocks of home builders such as KB Home (NYSE:KBH), D.R. Horton Inc (NYSE:DHI), and Lennar Corp Class A (NYSE:LEN). This is also a positive for mortgage companies such as Rocket Companies Inc (NYSE:RKT).

- President Trump says oil majors will spend $100B to support U.S. goals in Venezuela.

- The Supreme Court may rule on tariffs today. The consensus is the Supreme Court will find a way to support President Trump. Prudent investors need to know that companies are already lining up to seek refunds of tariffs they have paid in case the Supreme Court rules against the tariffs. The Supreme Court decision may be market moving especially if the Supreme Court rules against the tariffs.

Housing Starts

Housing starts came worse than expected, but builders are optimistic as demonstrated by higher building permits. Here are the details:

- September housing starts came at 1.306M vs. 1.320M consensus.

- September building permits came at 1.415M vs. 1.340M consensus.

- October housing starts came at 1.246M vs. 1.340M consensus.

- October building permits came at 1.412M vs. 1.355M consensus.

China And Japan

China continues to put more pressure on Japan due to Japan's support for Taiwan. China appears to be emboldened by U.S. action in Venezuela. In the latest move, China is restricting exports of rare earths to Japan.

Magnificent Seven Money Flows

Most portfolios are now heavily concentrated in the Mag 7 stocks. For this reason, it is important to pay attention to early money flows in the Mag 7 stocks on a daily basis.

In the early trade, money flows are positive in Apple Inc (NASDAQ:AAPL), Nvidia (NVDA), Alphabet Inc Class C (NASDAQ:GOOG), and Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are neutral in Amazon.com, Inc. (NASDAQ:AMZN) and Meta (META).

In the early trade, money flows are negative in Microsoft Corp (NASDAQ:MSFT).

In the early trade, money flows are positive in S&P 500 ETF (SPY) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (GLD). The most popular ETF for silver is iShares Silver Trust (SLV). The most popular ETF for oil is United States Oil ETF (NYSE:USO).

Bitcoin

Bitcoin (CRYPTO: BTC) is seeing selling.

What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

- No comments yet. Be the first to comment!