Cardlytics Inc. (NASDAQ: CDLX) saw its stock fall 9.85% during regular trading on Thursday. However, the stock rebounded in after-hours trading, climbing 5.04% to $2.50 following positive remarks from analysts.

Check out the current price of CDLX stock here.

Wells Fargo Partnership Creates Tailwinds

Citron Research highlighted that Wells Fargo Co. (NYSE: WFC) uses Cardlytics’ platform to process credit card offers, according to a post on X.

As Wells Fargo expands its credit card efforts, Cardlytics stands to gain directly from the rise in transaction volume.

Citron Research Drives Momentum

The California-based hedge fund manager believes Cardlytics is well-positioned to tap into the retail media market, which is expected to reach $100 billion by 2028. This opportunity arises as Google (NASDAQ: GOOG) (NASDAQ: GOOGL) and Meta (NASDAQ: META) move away from traditional tracking cookies.

See Also: Oracle Stock Rises After Trump Signs Executive Order On TikTok

CDLX surged 73.4% on September 18 following AmEx Platinum card refresh news

Growth Potential Despite Decline

Cardlytics, the Atlanta-based fintech company, has seen its stock decline by 35.85% year-to-date. Over the past year, the stock has ranged from $0.85 to $5.25. The company's market capitalization stands at $126.70 million, with an average daily trading volume of 8.48 million shares.

Price Action: According to Benzinga Pro data, CDLX closed on Thursday at $2.38.

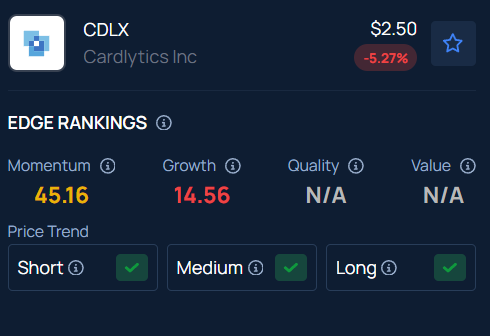

Benzinga Edge Stock Rankings indicate that CDLX has a positive price trend across all time frames. Track the performance of other players in this segment.

Read Next:

Photo Courtesy: Gorodenkoff on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

- No comments yet. Be the first to comment!