The European Union (EU) has fallen behind the US and China in the global AI leadership race, a gap that threatens the bloc's long‑term competitiveness and industrial growth.

Politicians and tech leaders provided stark warnings at the World Economic Forum (WEF) in Davos this month. The message: Europe needs to change its course to remain tech competitive and spur economic growth.

"Germany and Europe have wasted incredible potential for growth in recent years by dragging feet on reforms in unnecessarily and excessively curtailing entrepreneurial freedoms and personal responsibility," German Chancellor Friedrich Merz has said during his address at Davos. "We must reduce bureaucracy substantially in Europe. We have become the world champion of overregulation. That has to end."

High electricity costs, over‑regulation, and geopolitical instability have weighed heavily on Europe's AI and tech adoption. Europe has experienced geopolitical uncertainty. Iran and Greenland have emerged as new flashpoints testing Europe's resolve, from tensions with the US to Arctic resource competition.

The prolonged Russia-Ukraine war has weaponized pipelines, leading to EU sanctions and diversified imports. Natural gas prices in Europe surged 30% in the week ending January 21.

The warnings weren't limited to commodity markets. Across Davos, political leaders and tech executives pointed to deeper structural issues.

US Warns Europe About Policies

At Davos, US President Donald Trump and senior cabinet members delivered unusually direct criticism of Europe. Trump targeted Europe's net‑zero ambitions, mass migration policies, and "ever-increasing" government spending.

Europe's "not heading in the right direction," the president said.

"China makes almost all of the windmills, and yet I haven't been able to find any wind farms in China," he said. "They sell them to the stupid people that buy them, but they don't use them themselves…They use a thing called coal, mostly."

Trump emphasized massive energy expansions, declaring AI "massive" and urging tech firms to build their own nuclear plants. European spot electricity prices remain 2-3 times higher than in the USA.

Tech leaders echoed those concerns. They warned that Europe's challenges run deeper than electricity prices. Palantir Technologies Inc.'s CEO Alex Karp said that Europe must confront its tech adoption gap.

"The tech adoption in Europe is a serious and very, very structural problem," he told BlackRock Inc's CEO Larry Fink. "What scares me the most is, I haven't seen any political leader just stand up and say we have a serious and structural problem that we are going to fix."

EU Official Calls for Homegrown Power

European Commission President Ursula von der Leyen used her WEF address to call for accelerating domestic power generation to support rising AI‑driven electricity demand.

"We are massively investing in our energy security and independence with interconnectors and grids," von der Leyen said. Nuclear and clean-energy sources are seen as a path to avoid price volatility and supply shocks.

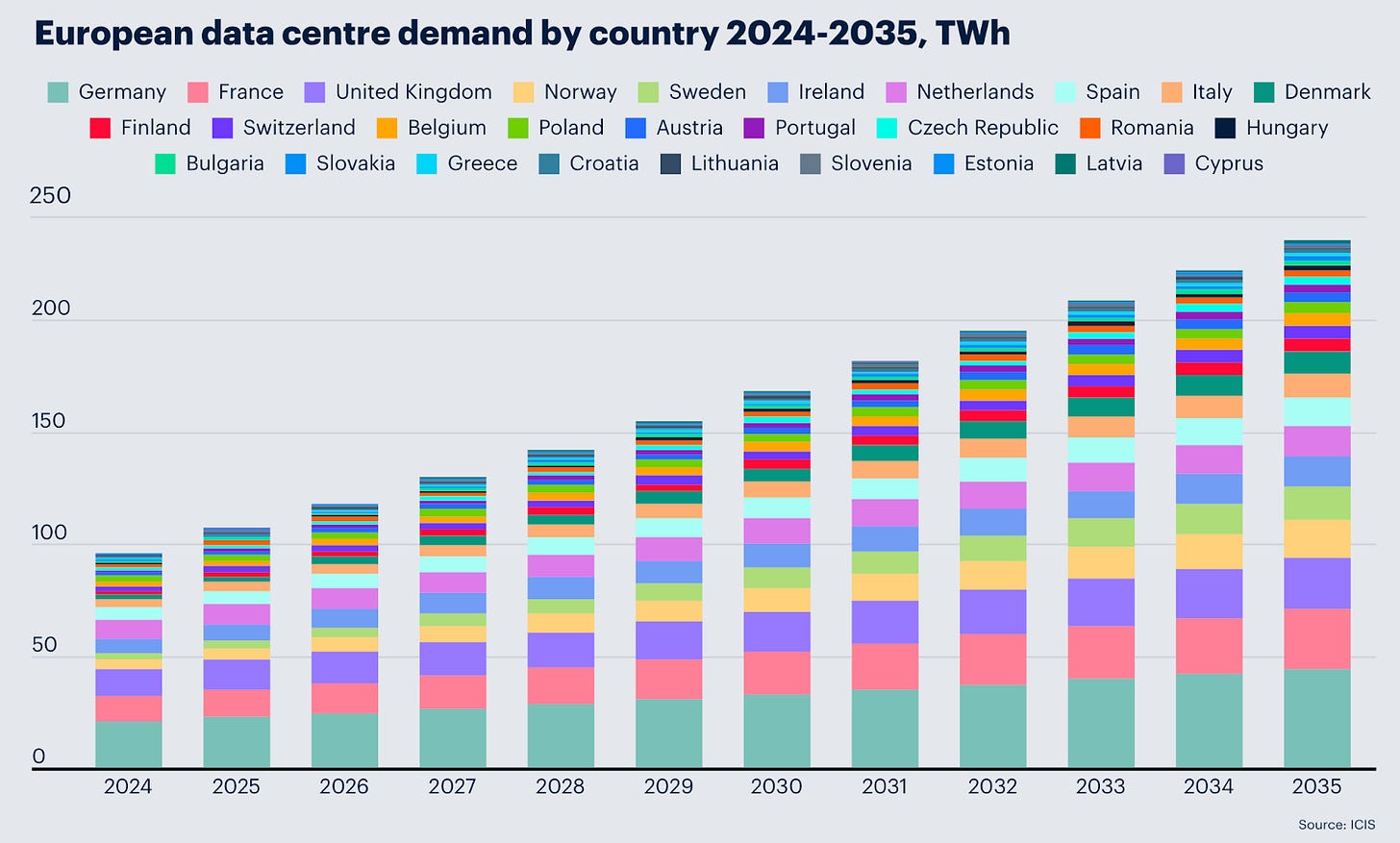

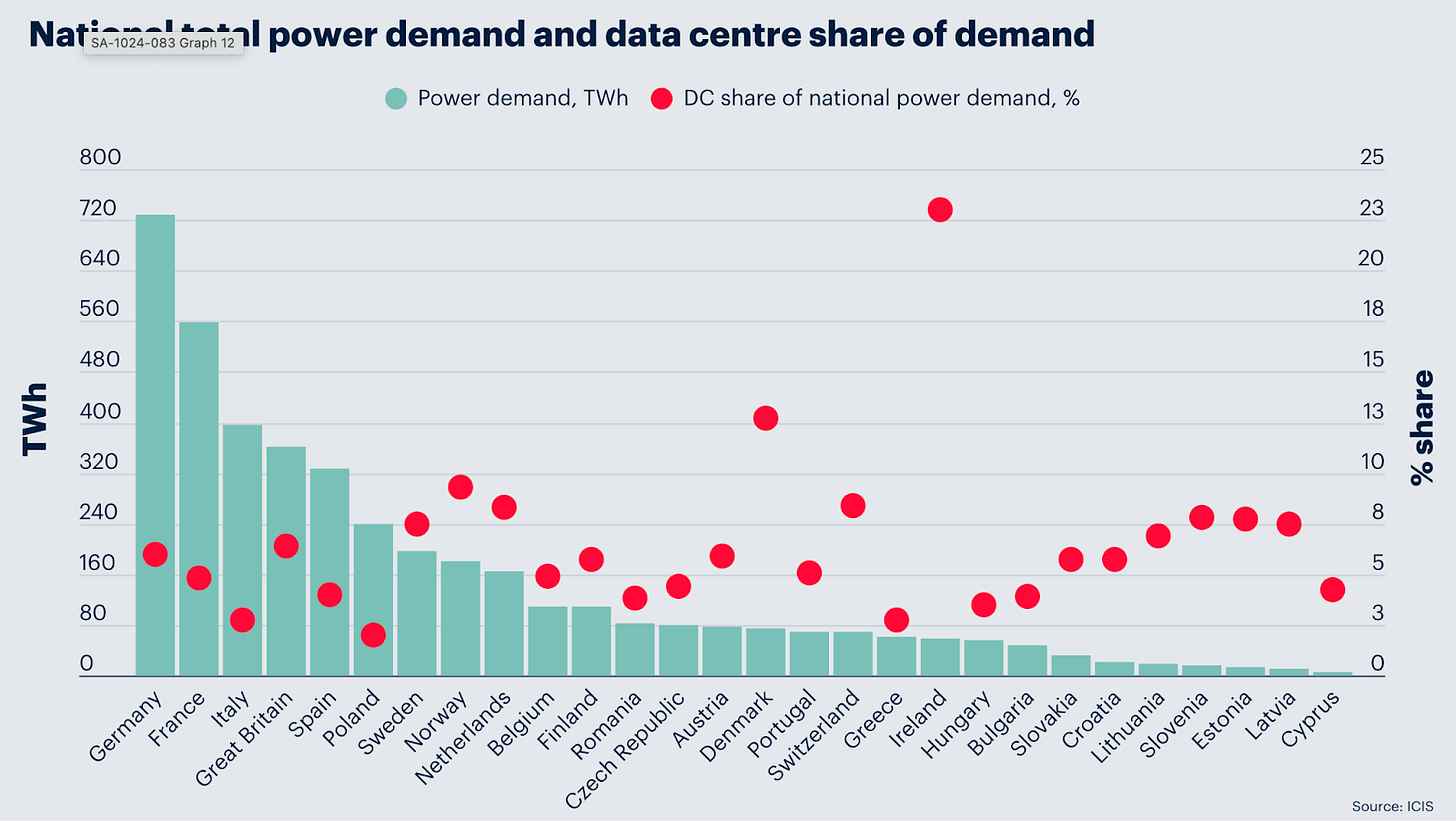

Europe's data center power demand will grow 2.7% to 5% of total electricity use between 2025 and 2030. By 2035, that demand in Europe will rise to 236TWh, the London-based Independent Commodity Intelligence Services (ICIS) has projected.

Ireland allocated about 21% of its electricity to data centers in 2023, with that forecast to rise to 32% this year, the International Energy Agency (IEA) said. This has outpaced all urban households.

The continent's AI ambitions will add 85 terawatt-hours of demand by 2030, according to McKinsey & Co. That will require rapid expansion of reliable, low-carbon power generation.

EU Relies on Renewables

Renewable energy provided 46% of total EU energy production in 2023, according to Eurostat data. Nuclear energy provided 29%, followed by solid fuels at 17%, natural gas at 5%, and crude oil at 3%.

Natural gas has increasingly provided energy for Europe’s data centers and AI infrastructure, providing as much as 50% of the 70-96 TWh of current demand, the IEA/EU estimated in 2024. Nuclear power has provided as much as 30% of the power for data centers in France.

The IEA has estimated that total usage will rise to 115-168 TWh by 2030. Ireland's centers, accounting for 21% of national power usage, lean on gas at 42% after exiting coal, with renewables at 39.6%, insufficient for 24/7 AI loads.

Germany, the UK, France, and the Netherlands lead Europe's data center count. Germany's grid queues stretch up to seven years, the IEA said in a report.

US Tech Giants Investing in European Data Centers

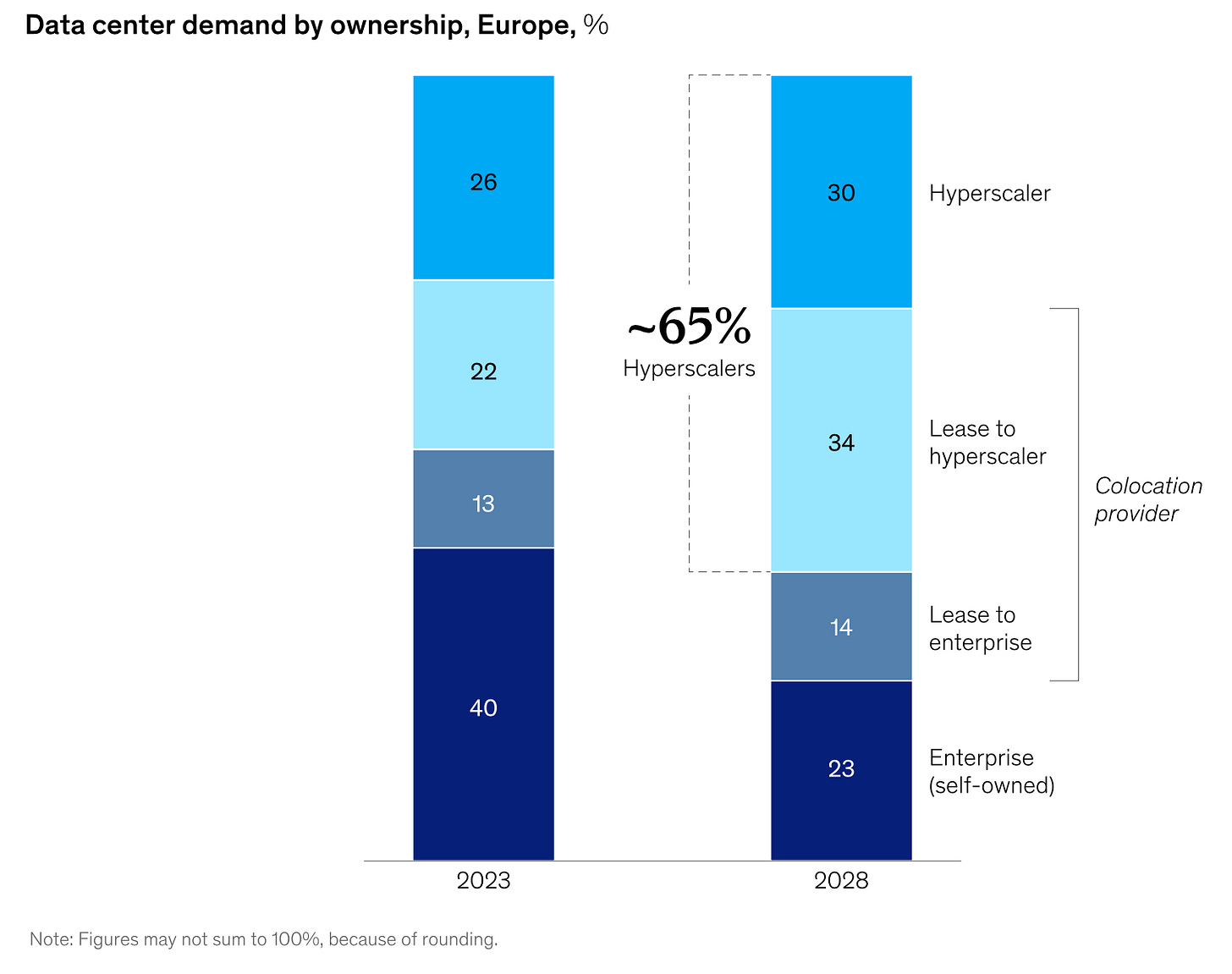

US tech giants have expanded in Europe, anticipating soaring demand for AI‑ready infrastructure.

Microsoft (NASDAQ:MSFT) plans to invest €3.2 billion in German data centers by 2025, aiming for 100% renewable power, relying on grid expansions. Data from 2024 shows that Microsoft has been running data center operations in Ireland, Sweden, the Netherlands, and Poland.

Google (NASDAQ:GOOGL) has operated hyperscale facilities in Finland and Belgium and has signed clean energy generation contracts for 4.5GW of energy. Amazon (NASDAQ:AMZN) Web Services has signed the first European Union (EU) Battery Energy Storage System (BESS) PPA that includes a 4 MW rooftop solar photovoltaic system paired with a BESS in Spain.

"Data centers must secure fast, uninterrupted power (cut grid delays, add backups), CO2-free PPAs, and on-site generation to conquer energy intermittency," McKinsey said in a 2024 report.

Yet EU red tape on low-carbon mandates risks choking the reliable power surge needed for AI data centers.

Elon Musk Sees Space as Data Center Solution

As Europe struggles with rising energy costs and regulatory hurdles, some US tech leaders are looking far beyond the continent for solutions. Elon Musk, the CEO of Tesla Inc. (NASDAQ:TSLA), told Fink that space will soon host the cheapest AI data centers.

"It's a no-brainer for building AI, solar-powered AI data centers in space because it's very cold in space," Musk said. "You have your solar panels facing the sun and then a radiator that's pointed away from the sun as a very efficient cooling system. The net effect is that the lowest cost place to put AI will be space."

Musk warned at Davos that "power constraints will bottleneck AI." Europe must bolster its power sources to avoid falling further behind.

"You don't write AI—you teach AI," NVIDIA Corp. (NASDAQ:NVDA) founder and CEO Jensen Huang said at WEF. He urged Europe to leverage its factories for physical AI and robotics, calling it a "once-in-a-generation opportunity" that will create six-figure skilled-trade jobs.

Disclaimer: Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

- No comments yet. Be the first to comment!